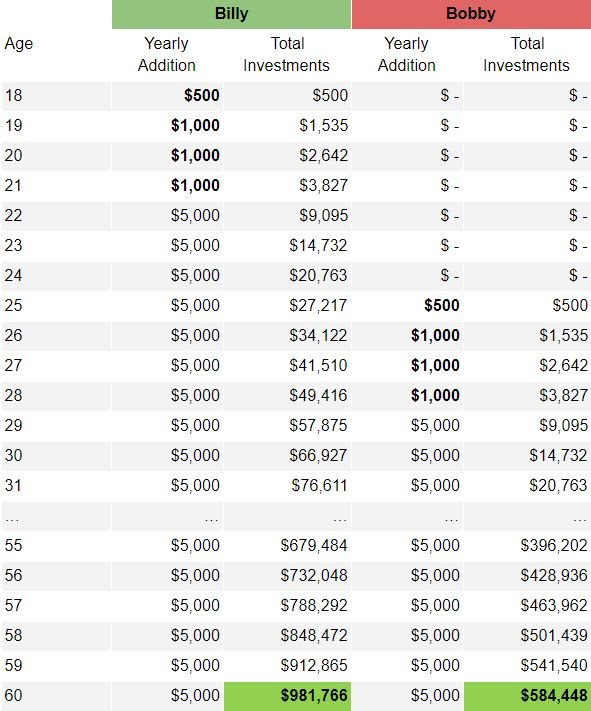

One of the keys to building wealth is to start investing early and often. To illustrate this point, we’ve developed this chart outlining the different outcomes of two people starting to invest at different stages in their lives.

Here’s the story: Billy and Bobby both started their investing careers with the same schedule of yearly contributions: $500 in year 1, $1,000 in years 2, 3 and 4, and $5,000 each year thereafter through the age of 60.

Billy started at age 18, but Bobby didn’t start until age 25. When they are both 60 years old, assuming they both achieved an average rate of return of 7% on their investments, Billy’s investment account dwarfs Bobby’s by almost $400,000. Amazing!

If you are ready to get excited about investing diligently, you can play around with some different contribution amounts and interest rates on a compound interest calculator like moneychimp. These can be fun and motivating tools that will encourage you to tighten up your budget and save and invest on a consistent basis.

Happy Investing!